Tourist Development Tax

Welcome to Santa Rosa County Tourist Development Tax (TDT). Our objective is to make complying with the Tourist Development Tax easy and understandable.

To view the latest TDT Reports, please visit the Financial Reporting and Internal Audits page.

New Tourist Development Tax Filing System

The Santa Rosa County Clerk of Court implemented a new and improved Tourist Development Tax online filing system effective April 1, 2025. This system is designed to enhance user experience and streamline the tax filing process for our customers. The new online system is live and ready for use. New features simplify the filing process, increase accessibility, and provide better support for our customers.

Click here for more information.

Getting Started With Our New System

I am an existing TDT account holder. What do I need to do?

All existing account holders with the Santa Rosa County TDT office will receive a letter with instructions to activate their new account. The letter will include your activation code that is needed to access the portal and your new Santa Rosa County TDT account. You may use the link to the Tourist Development Tax Online Filing System provided on our website on or before April 1, 2025, to activate your account. If your rental property is represented by an agent, management company, or representative (including tenants who lease a property long-term and then sublet the property short-term), you will be required to acknowledge your responsibility to the Tourist Development Tax should your agent, manager, or representative default on collecting and remitting the taxes due to Santa Rosa County. The Property Owner’s Authorization and Acknowledgement form previously needed is now electronically included in your registration process. You will be prompted to read and acknowledge your responsibility for TDT when you enter your manager or representative’s information.

I have not received an activation letter for my existing TDT account. What do I do?

Please email us at touristdevelopmenttax@santarosaclerks.com to request assistance.

I am new and do not have an existing account. How do I register?

If you are new and need to establish an account to file your TDT, you will visit our new site beginning April 1, 2025, and select Register Here: santarosacountyfl.munirevs.com

What is the Tourist Development Tax?

The Tourist Development Tax is a local sales tax on transient rentals, which is authorized and governed by Florida Statute 125.0104 and is collected by the Santa Rosa County Clerk of Court. The Tourist Development Tax (TDT) is a vital funding source that supports the growth and enhancement of local tourism. As travelers explore our beautiful region, the revenue generated from the TDT is reinvested into maintaining beaches, parks, and attractions, as well as improving hospitality services and facilities. Property owners/ Management companies are responsible for charging, collecting, and then remitting TDT to Santa Rosa County. TDT is filed monthly to the Clerk of Court’s Office, due by the 1st of the month. Late filing penalty and interest are charged for returns that are not filed and paid by the 20th of the month following the month revenues are received.

AIRBNB, HOMEAWAY, & VRBO CUSTOMERS

Please note that Santa Rosa County is NOT contracted with ANY platform, including the ones mentioned above, to receive taxes on your behalf. Therefore, it is your responsibility to collect & remit any Tourist Development Tax (TDT or “bed tax”) to the Santa Rosa County Clerk of Court & Comptroller.

Frequently Asked Questions

- What is the Santa Rosa County TDT rate?

- Santa Rosa County Tourist Development Tax is 5%

- Santa Rosa County Tourist Development Tax is 5%

- Are there other taxes I must collect on my rentals?

- Yes, in addition to the Tourist Development Tax, you must collect and remit state sales tax (currently 6%) and local sales tax (currently 1%) to the Florida Department of Revenue. The total tax to charge your guests is currently 12%. You may register online with the Florida Department of Revenue. For more information, please visit the Florida Department of Revenue’s website at floridarevenue.com.

- What is a short-term rental?

- A short-term rental is the rental of sleeping accommodations in a hotel, motel, apartment, multiple unit structure, (duplex, triplex, quadraplex, condominium), rooming house, tourist or mobile home court (trailer court, motor court, recreational vehicle camp), single family dwelling, garage apartment, beach house or cottage, cooperatively-owned apartment, time share resort, mobile home, boat permanently docked, or any other house, for a period of less than 6 months.

- By what authority are these guidelines issued?

- The Florida Local Option Tourist Development Tax, Florida Statute 125.0104, permits the Board of County Commissioners of Santa Rosa County, Florida, to levy a tourist development tax. Florida Statutes Chapter 212 Tax on Sales, Use, and Other Transactions authorizes how the local option tax is administered, enforced, and audited by Santa Rosa County, Florida.

- The Florida Local Option Tourist Development Tax, Florida Statute 125.0104, permits the Board of County Commissioners of Santa Rosa County, Florida, to levy a tourist development tax. Florida Statutes Chapter 212 Tax on Sales, Use, and Other Transactions authorizes how the local option tax is administered, enforced, and audited by Santa Rosa County, Florida.

- What are the rules for collecting and remitting the Tourist Development Tax?

- Tourist Development Tax returns are due on the 1st of the month following the end of the collection period and are delinquent if payment is postmarked after the 20th. When the 20th falls on a Saturday, Sunday, or county/state/federal holiday, the postmark deadline shall be the next business day. Pursuant to Florida Statute 212.12, managers/owners are permitted to keep a collection allowance of 2.5% of the tax collected, up to a maximum of $30.00, when filing and paying online by the 20th of the month. If a return is delinquent, the collection allowance will not apply, and a penalty and interest will be due. The penalty is 10% of the tax due, with a minimum penalty of $50.00. Interest accrues daily at a rate of 12% per annum. If noncompliance continues, collection action is taken as outlined in the Florida Statutes. Managers/owners are also required to keep all records associated with rental revenue, in accordance with generally accepted accounting principles, for a period of three years. These records must be made available for audit upon a 60-day notice from the Santa Rosa County Clerk of Court.

- Tourist Development Tax returns are due on the 1st of the month following the end of the collection period and are delinquent if payment is postmarked after the 20th. When the 20th falls on a Saturday, Sunday, or county/state/federal holiday, the postmark deadline shall be the next business day. Pursuant to Florida Statute 212.12, managers/owners are permitted to keep a collection allowance of 2.5% of the tax collected, up to a maximum of $30.00, when filing and paying online by the 20th of the month. If a return is delinquent, the collection allowance will not apply, and a penalty and interest will be due. The penalty is 10% of the tax due, with a minimum penalty of $50.00. Interest accrues daily at a rate of 12% per annum. If noncompliance continues, collection action is taken as outlined in the Florida Statutes. Managers/owners are also required to keep all records associated with rental revenue, in accordance with generally accepted accounting principles, for a period of three years. These records must be made available for audit upon a 60-day notice from the Santa Rosa County Clerk of Court.

- Who pays the Tourist Development Tax?

- Generally, the person receiving the rental revenue (or his or her representative) is required to charge and collect the tax from the person paying the rent. In turn, the person receiving the rental revenue is required to remit the taxes to Santa Rosa County. Should the person receiving the rental revenue fail to collect taxes from the person paying the rent, the person receiving the rental revenue is responsible for paying the taxes to Santa Rosa County. However, Florida Statute assigns the ultimate responsibility to the property owner.

- Generally, the person receiving the rental revenue (or his or her representative) is required to charge and collect the tax from the person paying the rent. In turn, the person receiving the rental revenue is required to remit the taxes to Santa Rosa County. Should the person receiving the rental revenue fail to collect taxes from the person paying the rent, the person receiving the rental revenue is responsible for paying the taxes to Santa Rosa County. However, Florida Statute assigns the ultimate responsibility to the property owner.

- How do I register my account and file?

- Registration, filing, and payment can be completed through an online web portal at santarosacountyfl.munirevs.com/. Please be advised that failure to comply with short-term rental licensing requirements may result in additional fees, penalties, and/or a lien on your short-term rental property.

- Registration, filing, and payment can be completed through an online web portal at santarosacountyfl.munirevs.com/. Please be advised that failure to comply with short-term rental licensing requirements may result in additional fees, penalties, and/or a lien on your short-term rental property.

- When are Tourist Development Taxes Due?

- Gross revenue receipts are required to be reported and taxes paid by the 20th of the month following the month in which they are received.

- Gross revenue receipts are required to be reported and taxes paid by the 20th of the month following the month in which they are received.

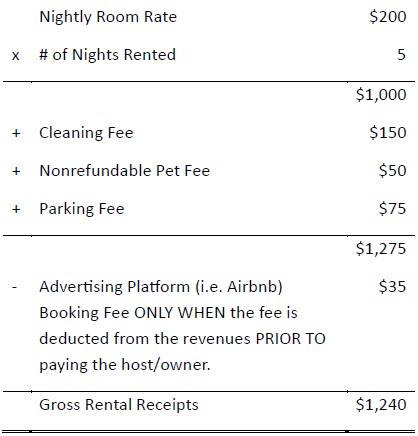

- What are gross rental receipts?

- Gross rental receipts are defined as those costs required to be paid by your guests to occupy the property. This includes any funds that are remitted to the host. The following example is provided as an AID to assist you in determining Gross Rental Receipts for TDT reporting purposes:

- Gross rental receipts are defined as those costs required to be paid by your guests to occupy the property. This includes any funds that are remitted to the host. The following example is provided as an AID to assist you in determining Gross Rental Receipts for TDT reporting purposes:

- What revenues are exempt from the Tourist Development Tax?

- All revenues received by a campground are ONLY WHEN an annual declaration is filed with the County that more than 50% of the total rental units available are occupied by tenants who have continuously resided in that unit for more than 3 months.

- Revenues received for a property where a bona fide, written, residential long-term lease has been executed for more than 6 months.

- Revenues received for the short-term rental of a property by active duty or reserve duty military personnel on TDY who have provided a copy of their orders.

- Revenues received from full-time students enrolled in a post-secondary education institution who have provided proof of status from the institution.

- Revenues received from a governmental agency or a non-governmental organization that holds a Consumer’s Certificate of Exemption issued by the Florida Department of Revenue, only when:

- The rental charges are billed directly to or paid directly by the governmental unit or exempt organization, and

- The employee or representative provides the owner or the owner’s representative of the transient accommodation with a Consumer’s Certificate of Exemption or, in the case of a federal employee, the proper documentation according to 12A-1.038(4), Florida Administrative Code.

- Does the County charge a late fee penalty and interest?

- To avoid a late filing penalty or late payment penalty of the greater of $50 or 10% of taxes due, ensure all returns are filed and taxes are paid by the 20th of the month following the month gross revenue receipts were received. Interest is also calculated at 12% per annum on taxes due and paid past the monthly due date until paid in full.

- To avoid a late filing penalty or late payment penalty of the greater of $50 or 10% of taxes due, ensure all returns are filed and taxes are paid by the 20th of the month following the month gross revenue receipts were received. Interest is also calculated at 12% per annum on taxes due and paid past the monthly due date until paid in full.

- Does the county require a return to be filed if revenues are not collected for a month?

- Zero returns MUST be filed by the 20th of the following month to avoid a late filing penalty.

- Zero returns MUST be filed by the 20th of the following month to avoid a late filing penalty.

- What is the collection allowance?

- A collection allowance is a tax deduction authorized by Florida Statute as compensation for electronically filing a tax return, reporting gross rental receipts, and paying taxes by the due date. The collection allowance is computed at 2.5% on the first $1,200 tax due. The maximum amount authorized for any filing period is $30.

- A collection allowance is a tax deduction authorized by Florida Statute as compensation for electronically filing a tax return, reporting gross rental receipts, and paying taxes by the due date. The collection allowance is computed at 2.5% on the first $1,200 tax due. The maximum amount authorized for any filing period is $30.

- Is the County working with Airbnb or VRBO to collect Tourist Development Taxes?

- No. Airbnb or VRBO does not collect or remit the Tourist Development Tax to the County on behalf of property owners.

- No. Airbnb or VRBO does not collect or remit the Tourist Development Tax to the County on behalf of property owners.

- All of my rentals are handled by a property management company. What are my Tourist Development Tax responsibilities?

- If your property management company is collecting and remitting tax for all of your property’s rentals under their Tourist Development Tax ID number, you are not required to file your own returns (although you may still need to register with the Florida Department of Revenue). However, if you personally collect rental revenue or any other form of compensation from any of your guests, you must collect and remit the taxes for those stays. Also, please be aware that, under Florida law, property owners are ultimately responsible for the tourist development tax if a property manager defaults or fails to collect or remit the tax.

- If your property management company is collecting and remitting tax for all of your property’s rentals under their Tourist Development Tax ID number, you are not required to file your own returns (although you may still need to register with the Florida Department of Revenue). However, if you personally collect rental revenue or any other form of compensation from any of your guests, you must collect and remit the taxes for those stays. Also, please be aware that, under Florida law, property owners are ultimately responsible for the tourist development tax if a property manager defaults or fails to collect or remit the tax.

- I have been renting for some time now, but was not aware of my responsibility to collect and remit the Tourist Development Tax. I’d like to begin complying, but I am afraid that I have a large tax liability. How does this work?

- Depending on the circumstances, there are several ways that a rental owner or manager making a voluntary disclosure of a tax liability can minimize their past amount due. Please be assured that we will work with you to bring your property into compliance with the law.